Working with a major European insurance company, I led the design of a transformative AI-powered claims system. Over 4 weeks, our team designed two pilot workflows: a 2027 automated simple claims experience and a 2030 modular AI orchestration for complex cases, creating the strategic foundation that secured executive approval and budget for development.

Client

NDA - Major European Insurance Company

role

Lead Product Designer

timeline

4 weeks | 2025

team

1 PM, 1 Business Designer, 2 Product Designers

The problem

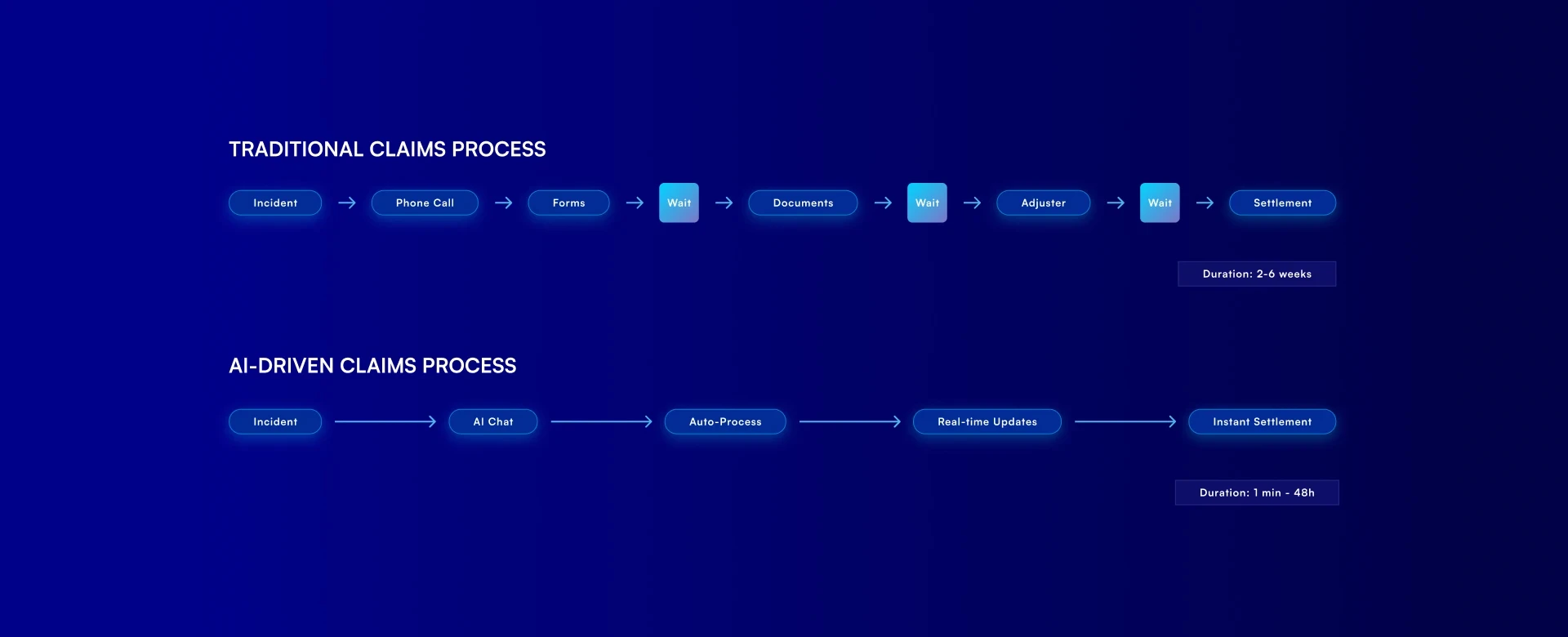

Claims processing is trapped between customer expectations and operational reality.

Modern customers expect Amazon-level service, but insurance claims still require manual document processing, phone calls, and weeks of silence. Through discovery sessions and exploratory research, we identified a critical gap: customers could track a $15 pizza delivery in real-time but waited weeks with zero visibility on thousand-dollar claims.

Current state pain points

Customer Experience: Manual FNOL (First Notice of Loss) submission, zero status updates, multi-week wait times for simple claims

Internal Operations: Significant manual processing, adjusters are buried in administrative work, and fragmented workflows across legacy systems

Business Impact: Declining customer satisfaction, rising operational costs, and competitive disadvantage

My role & approach

As Lead Product Designer, I directed the end-to-end design process:

Strategic Foundation

Participated in discovery sessions and expert interviews

Conducted exploratory research on AI trends and competitive landscape

Contributed to vulnerability analysis led by a business designer

Design Leadership

Led design team (2 Product Designers) through future scenario development

Designed two future-state pilot blueprints: 2027 simple claims automation and 2030 complex claims orchestration

Created executive storyboards and video simulations demonstrating the AI transformation vision

Research & discovery

Given the 4-week timeline, we focused on rapid, high-impact research:

Week 1-2: Understanding Current State

Discovery sessions with claims management teams

Exploratory research on industry trends, competitors, and emerging AI capabilities

Week 2-3: Validating AI Opportunities

Expert interviews with internal and external AI specialists

Vulnerability analysis evaluating business against AI disruption

Week 3-4: Defining Future Scenarios

Future scenario workshop mapping claims evolution (2025-2030)

Consolidation of most plausible scenarios

Key Research Insights

Adjusters spend the majority of their time on administrative tasks instead of expertise application

Digital-native insurers processing simple claims in under 24 hours

AI can handle significant document processing, but human expertise is critical for complex decisions

Market expectation shifting toward immediate resolution for simple claims

Design Strategy

Progressive Automation: 2027 to 2030

2027 Pilot: Automated Simple Claims

Target: Routine property damage with clear liability

Goal: Under 60 second resolution from submission to settlement

Approach: AI handles entire workflow, humans monitor for exceptions

2030 Vision: AI Orchestration for Complex Claims

Target: Multi-party liability, injury claims, catastrophic events

Goal: AI coordinates all routine tasks, humans focus on decisions

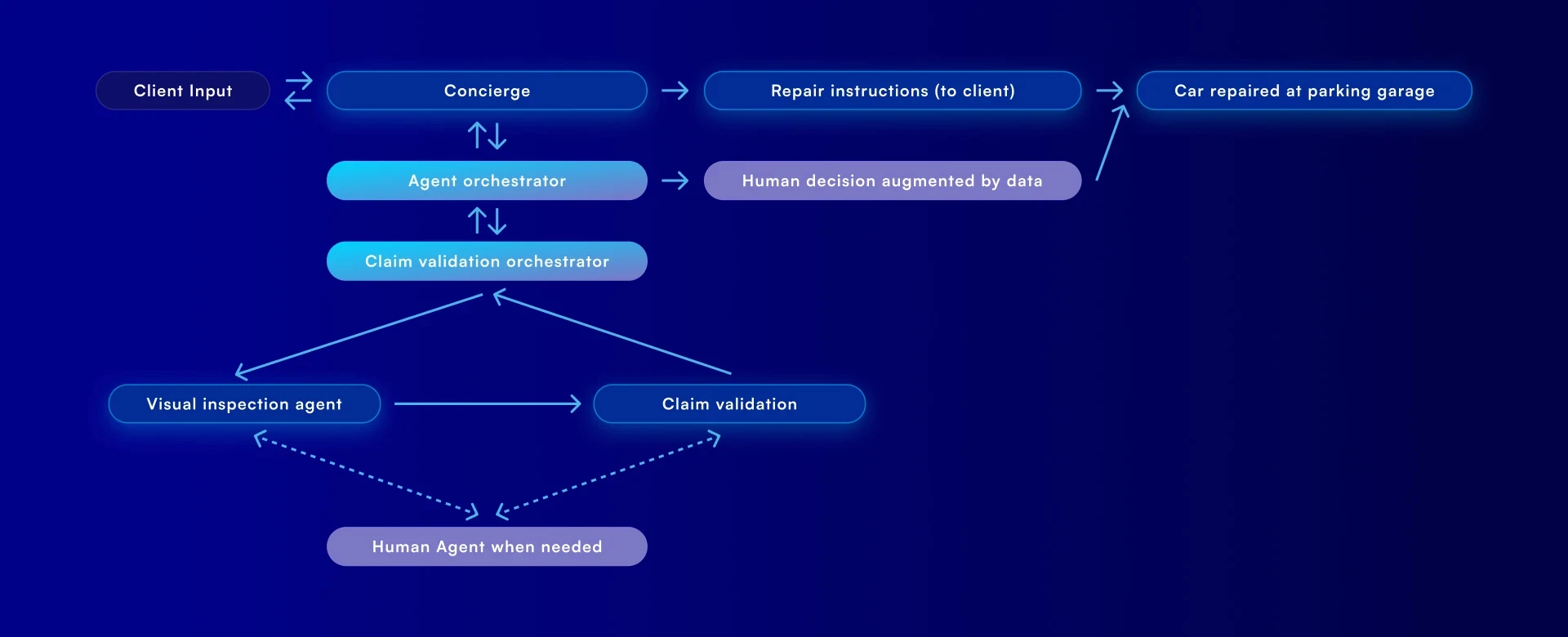

Approach: Modular agents handling specific tasks, human oversight on strategy

Key design decisions

Decision #1: Two-Phase Pilot Approach

Designing distinct 2027 (simple) and 2030 (complex) workflows allowed us to prove value incrementally rather than attempting risky full transformation immediately.

Decision #2: Conversational FNOL Instead of Forms

Natural language AI can extract structured data from conversation, reducing customer friction from multiple form fields to natural dialogue while improving data quality.

Decision #3: Real-Time Visual Damage Assessment

Visual AI analyzing photos instantly transforms multi-day assessment waits into 60-second processes for simple property damage.

Decision #4: Proactive Status Updates

Showing real-time claim progress eliminates repetitive status inquiry calls, improving customer satisfaction while freeing staff for complex cases.

The solution

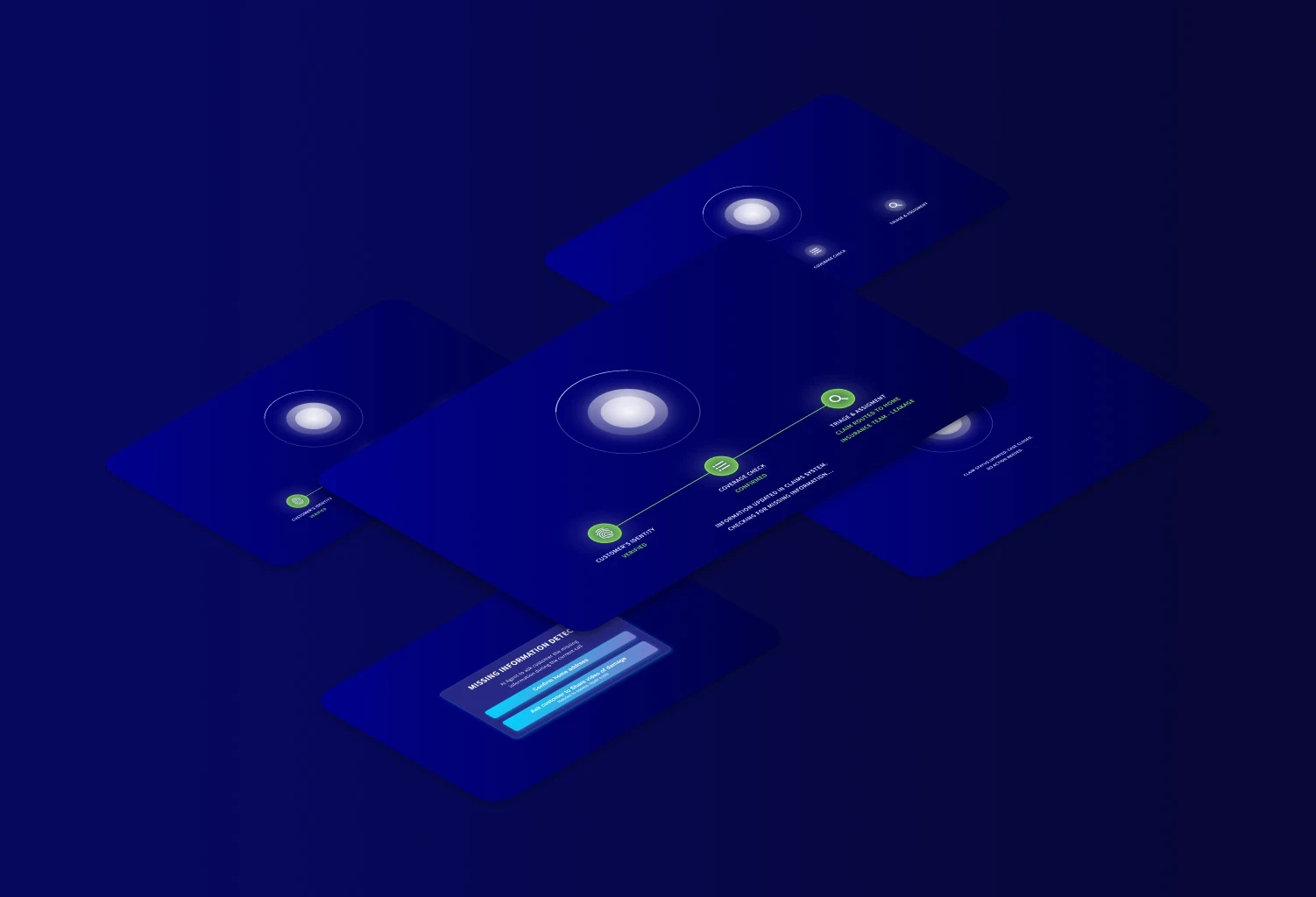

Two pilot workflows: phased AI transformation

I designed strategic blueprints mapping future-state experiences, system architecture, and service touchpoints, creating the foundation for technical development.

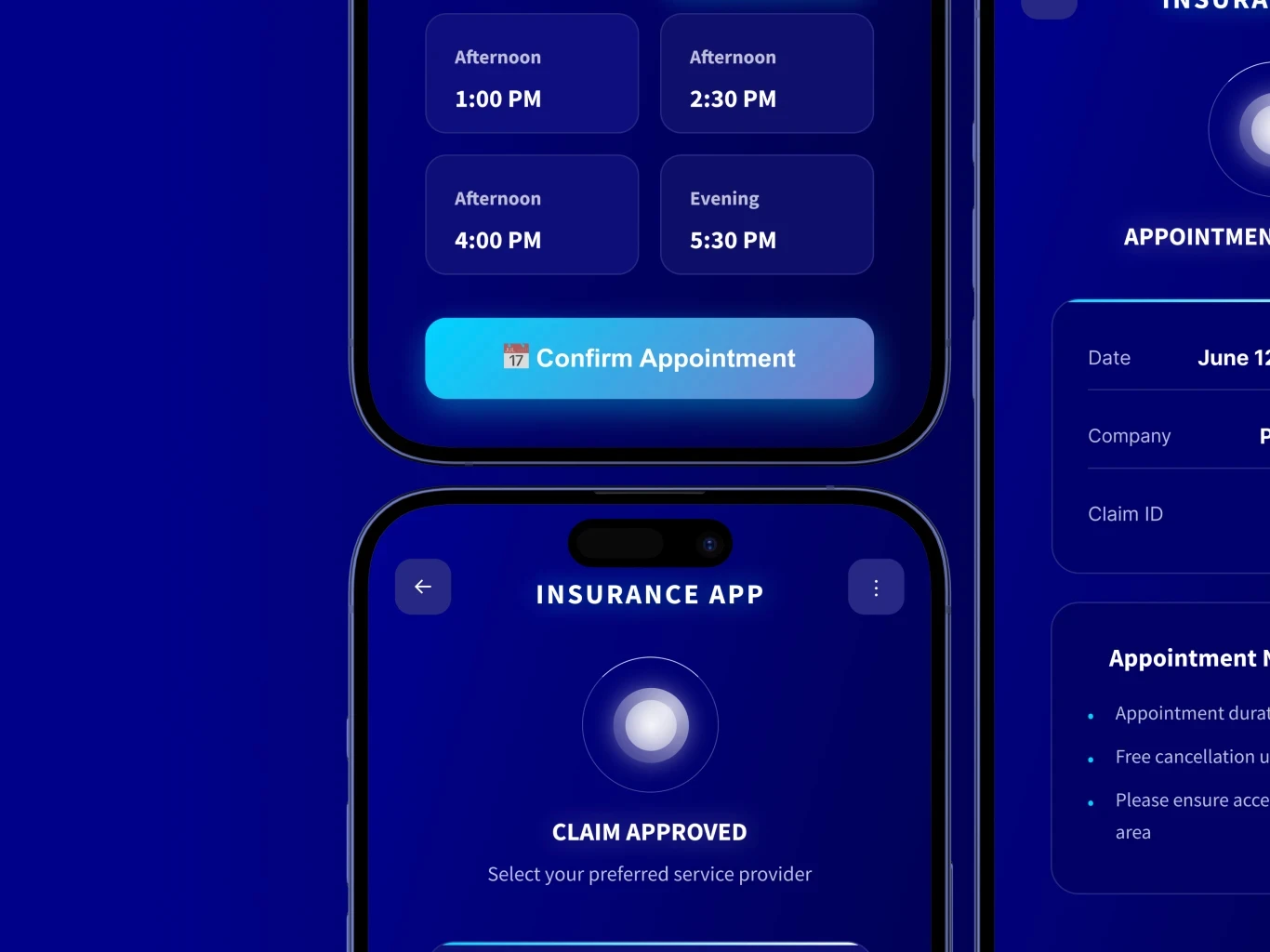

Pilot 1: 2027 Automated Simple Claims

1. Instant FNOL via Mobile

Conversational interface extracts claim details from natural language

No forms, minimal friction

2. Visual Damage Assessment

AI-guided photo capture with computer vision analysis

Instant repair estimate with fraud detection

3. Automated Settlement

System validates coverage and auto-approves claims meeting thresholds

Instant notification with payment timeline

Total Time: Under 60 seconds from submission to approval

What I Created

Service Blueprint: Customer journey across all touchpoints, AI agent responsibilities, human oversight triggers, system integration requirements

Experience Concepts: Wireframes showing potential conversation flow, photo guidance, status transparency, approval patterns, adjuster monitoring dashboard

System Architecture: AI agent orchestration logic, data flows, integration points, exception handling processes

Key Innovation: Defined how AI could handle entire simple claims workflow while maintaining human oversight for edge cases.

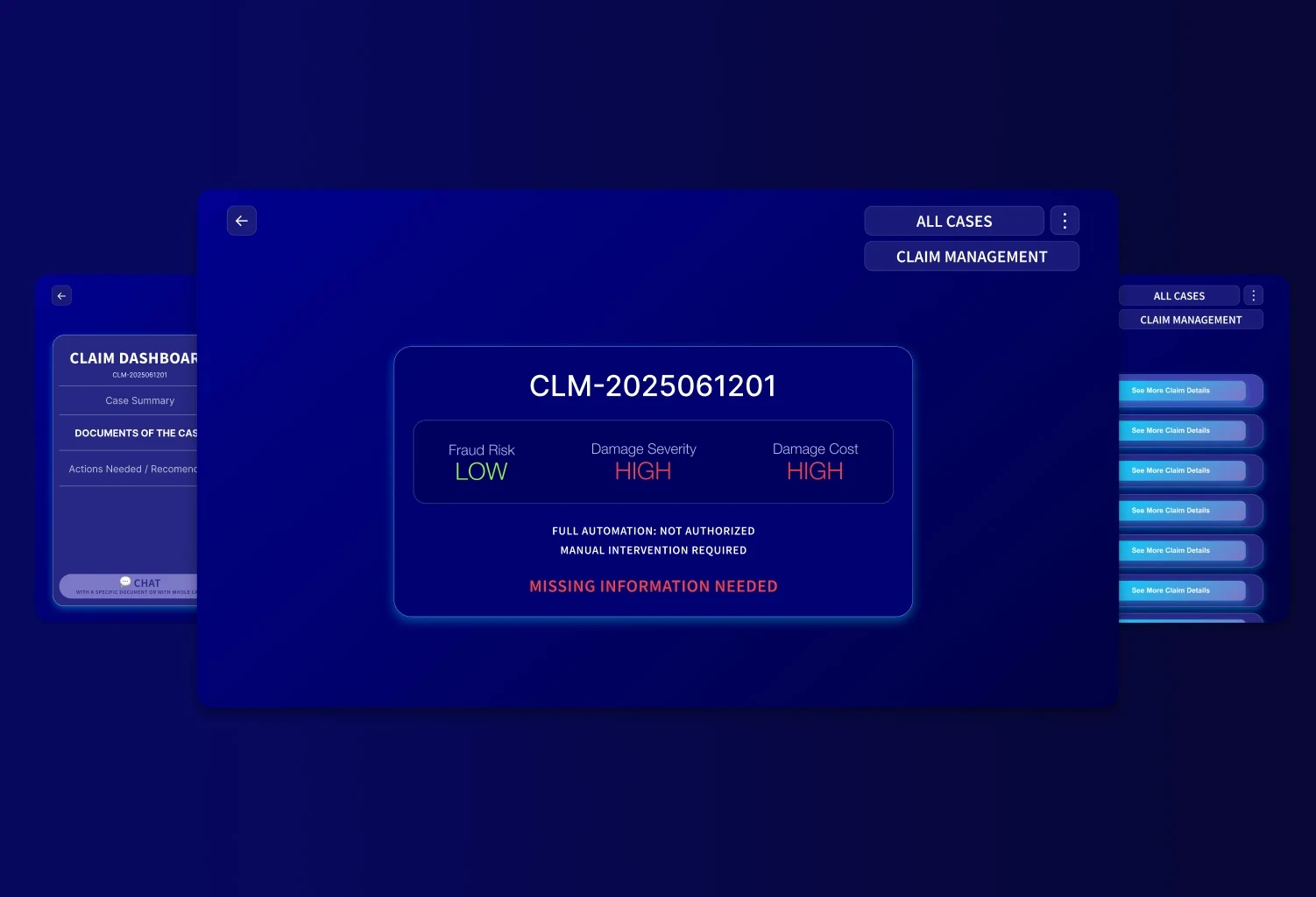

Pilot 2: 2030 Complex Claims Orchestration Blueprint

1. Intelligent Triage

AI analyzes complexity and triggers senior adjuster assignment

Human oversight was established immediately

2. Automated Evidence Assembly

AI orchestrates photo collection, police reports, and medical communications

Delivers a comprehensive case package to the adjuster in hours vs. days

3. AI-Assisted Decision Support

System suggests liability analysis, flags conflicts, and surfaces precedents

Adjuster makes final determination with AI insights

4. Ongoing Orchestration

AI manages routine communications and tracking

An adjuster focuses on negotiation, empathy, and strategic decisions

What I Created

Service Blueprint: End-to-end orchestration across all parties, AI coordination logic, human decision points, workflow from triage to settlement

Experience Concepts: Adjuster dashboard wireframes, communication hub, evidence assembly interfaces, decision support visualizations, timeline showing AI-handled vs. human-decided activities

System Architecture: Multi-agent orchestration model, human-AI collaboration patterns, escalation mechanisms, quality assurance checkpoints

Key Innovation: Defined how AI agents coordinate complex workflows while preserving human expertise for judgment and strategy

System architecture overview

Five core AI agent concepts:

Claims Concierge: Customer conversation, data extraction, routing

Visual Assessment: Photo analysis, damage estimation, fraud detection

Triage: Complexity classification, routing, priority assignment

Orchestration: Multi-party coordination, evidence assembly

Settlement: Coverage validation, payment processing

Human Oversight: Exception monitoring, quality assurance, escalation triggers, strategic decision checkpoints

Results & key learnings

Project outcome

Our comprehensive deliverables (executive storyboard, service blueprints, and video simulations) enabled the internal claims team to successfully present the AI transformation vision to executive leadership in 2025, securing budget approval for development.

What I've learned

Blueprint work drives strategic alignment

Designing future-state systems without final UI forced us to focus on fundamental experience logic and architecture rather than pixel-perfect execution. This strategic approach (combined with video simulations that made the vision tangible) proved more valuable for executive decision-making than polished mockups would have been.

Modular thinking enables buy-in

Designing composable AI agents (vs a monolithic system) allowed stakeholders to envision a gradual rollout. "We can start with just a visual assessment," made the investment feel manageable and reduced perceived risk.

AI as partner, not replacement

Framing AI as intelligent support—not replacement—drove stakeholder embrace. When adjusters understood AI would handle the administrative burden so they could focus on complex decisions, the vision shifted from threatening to empowering.

What I'd Do Differently

Test with more end users

Limited direct customer and adjuster involvement. More co-design sessions would have strengthened experience logic and surfaced edge cases earlier.

Create Interactive Prototypes

Video simulations were effective, but interactive prototypes would have allowed stakeholders to dynamically explore "what if" scenarios during presentations.

Document More Edge Cases

Focus on primary scenarios left technical teams needing more guidance on edge cases like fraud, disputes, denials, and system failures.

Key Takeaway

Strategic design work isn't about polished pixels; it's about creating compelling visions that align stakeholders around a transformative future while defining the architecture to get there.

Success resulted from making a complex AI future feel real and reachable through clear plans, engaging storytelling, and modular thinking that let stakeholders picture the path from the current state to the future.